MONDAY, APRIL 10, 2017

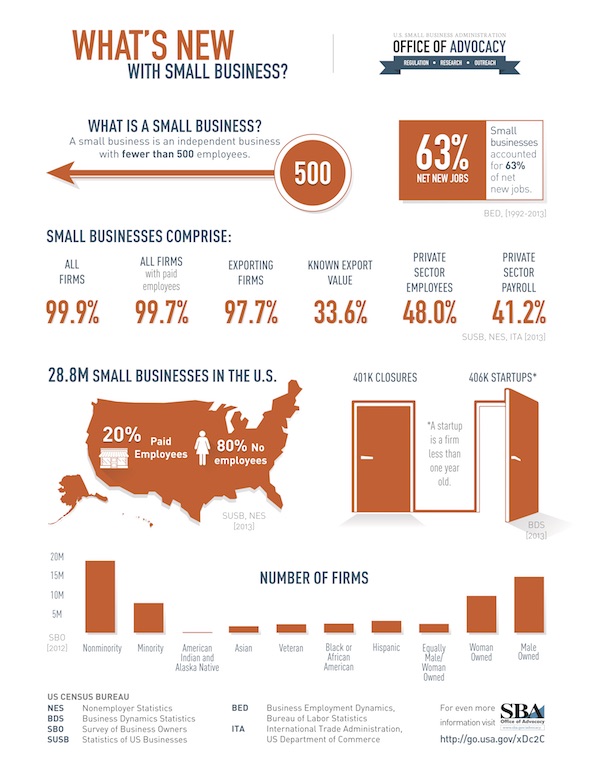

Orlando, FL - In today’s economy having a home based business is no surprise, as a matter of fact it’s become very popular. According to recent U.S. Small Business Administration data, over fifty percent of all American businesses are home-based.

Orlando is not an exception, with more and more communities built to enhance and improve the quality of life of its residents, many couples choose to have one steady income while the other stays at home, working of course. It is not just convenient, but it allows them to support their household while having some flexibility to take care of their family and other domestic needs.

Whether it is a business you started alone or you have a few employees, your business should be insured against risk —- which, by the way, may not be covered by a homeowners policy alone.

Are you prepared to respond to liability issues? What about loss of business property?

Unfortunately for every business owner across the nation and in Florida, the chances of getting sued have dramatically increased in the last decade.

If you work alone you are probably starting with a fairly small revenue. We get it!

Most business owners, including home-based businesses, can’t visualize the impact of unpredicted events, to their small operation. Having an appropriate Business Owners Policy (BOP) coverage can mark the difference between escalating your business’ success to the next level, or failing to pursue your very own dream.

By definition, a home-based business is a small business with specific location characteristics that need to be addressed in your insurance coverage.

A typical Business Owners Policy covers businesses with fewer than 100 employees and revenues of up to five million dollars or less, but you can customize your policy to cover the specific needs of your home-based profession through a standardized small business policy. The latter will offer you and affordable way to protect your company against most common risks.

To give you an idea, a General Liability coverage will help you compensate for loss arising from real or alleged— bodily or personal injury or property damage, on your business premises or as a result of your operations.

Also, General Liability insurance can prevent a legal suit from turning into a financial disaster by providing financial protection in case your business is ever sued or held legally responsible for some injury or damage.

Broad Range of General Liability Protection

-

Bodily Injury, including the cost of care, the loss of services, and the restitution for any death that results from injury

-

Property Damage coverage for the physical damage to property of others or the loss of use of that property

-

Products-Completed Operations provides liability protection (damages and legal expenses up to your policy's limit) if an injury ever resulted from something your company made or service your company provided

-

Products Liability is a more specialized product liability insurance that protects your company against lawsuits from product-related injury or accidents

-

Contractual Liability extends to any liability you may assume by entering into a variety of contracts

-

Other coverage includes: Reasonable Use of Force; Borrowed Equipment; Liquor Liability; Non-Owned Vehicles (such as aircraft and watercraft); Fire, Lightning or Explosion Damage; Water Damage Liability Protection; Legal Defense Costs; Medical Payments; Personal Injury; Advertising Injury; and specialized liability protection for specific business types.

The best part of it all? Luck is on your side, and now you have one of our business insurance experts available to answer

questions and help you develop the perfect strategy to protect this important aspect of your work/life balanced life. Enjoy!

For personal insurance solutions visit our sister company Orlando Insurance Center

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

2024

2023

2022

2021

2020

2019

2018

2017

|